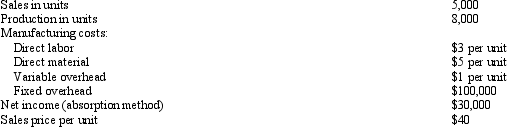

Austin Company The following information is available for Austin Company for its first year of operations: Refer to Austin Company.If Austin Company had used variable costing,what amount of income before income taxes would it have reported?

Refer to Austin Company.If Austin Company had used variable costing,what amount of income before income taxes would it have reported?

Definitions:

Repurchase Shares

A transaction in which a company buys back its own shares from the marketplace, reducing the amount of outstanding stock.

Return on Assets

A profitability ratio that measures how efficiently a company is using its assets to generate earnings.

Return on Debt

A measurement of a company's effectiveness in generating earnings from its debt, showing how well a company uses borrowed funds.

Q12: Mistakes not eliminated by prevention costs may

Q20: Austin Company The following information is available

Q29: Contero Products has no Work in Process

Q34: In a Pareto inventory analysis,the items that

Q80: When implementing TQM,an organization should establish long-term

Q127: What are three reasons that overhead must

Q150: If the level of activity increases,<br>A)variable cost

Q151: Underapplied factory overhead that is material in

Q156: Preparation of a value chart is the

Q163: Another name for absorption costing is<br>A)full costing.<br>B)direct