On December 30,a fire destroyed most of the accounting records of the Alcorn Division,a small one-product manufacturing division that uses standard costs and flexible budgets.All variances are written off as additions to (or deductions from)income; none are pro-rated to inventories.You have the task of reconstructing the records for the year.The general manager informs you that the accountant has been experimenting with both absorption costing and variable costing.

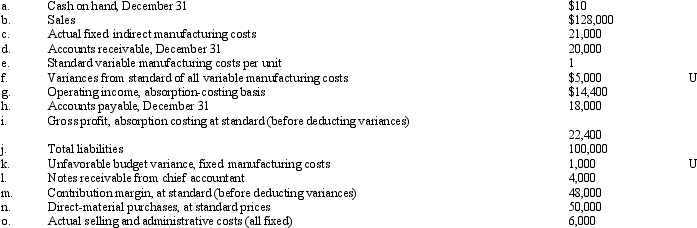

The following information is available for the current year:

Required:

Required:

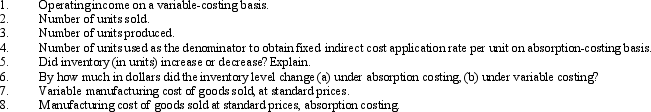

Compute the following items (ignore income tax effects).

Definitions:

Clayton Act

A U.S. antitrust law, adopted in 1914, aimed at protecting competition by prohibiting certain actions that lead to anticompetitiveness.

Celler-Kefauver Act

A U.S. law enacted in 1950 to amend the Clayton Act, aiming to prevent anti-competitive mergers and acquisitions by prohibiting the acquisition of assets if the effect reduces competition.

Mergers

The combination of two or more companies into one entity, often to enhance market share and reduce competition.

Celler-Kefauver Act

A U.S. law enacted in 1950, aimed at preventing anti-competitive mergers and acquisitions that could create monopolies or reduce competition.

Q5: Variable costing considers which of the following

Q13: A credit to the Factory Overhead account

Q21: Given the following information for Moore Corporation,prepare

Q55: The performance measure that considers routine interruptions

Q58: One of the obstacles to implementing open-book

Q66: The economic order quantity is not affected

Q72: A cost that shifts upward or downward

Q110: Drew Corporation is relocating its facilities.The company

Q113: If underapplied or overapplied factory overhead is

Q130: It is necessary for an organization to