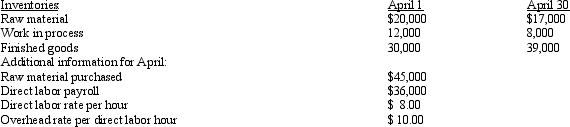

Goodwin Enterprises  Refer to Goodwin Enterprises.For April,conversion cost incurred was

Refer to Goodwin Enterprises.For April,conversion cost incurred was

Definitions:

Risk-free Rate

The theoretical return on an investment without any risk of financial loss, typically represented by the yields on government securities.

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specific amount of an underlying asset at a set price within a specified timeframe.

Black-Scholes

A model used to price European options, calculating the theoretical price for derivatives based on factors like volatility, time, and the risk-free rate.

Standard Deviation

A statistical measure of the dispersion or variability of a set of values, indicating how much individual values within a data set differ from the mean or average value.

Q9: When a firm adopts the just-in-time method

Q21: _ is a philosophy of increasing a

Q21: A control chart graphs<br>A)actual process results relative

Q34: EMS stands for<br>A)environmental manufacturing system.<br>B)employee management system.<br>C)emergency

Q36: In an ERP system,data is decentralized among

Q37: Building depreciation is generally considered an organizational

Q41: Parrish Company Parrish Company uses activity-based costing.The

Q93: The evaluation of future long-range projects to

Q95: Most discretionary costs relate to<br>A)plant and equipment

Q134: An investment in inventory yields a return