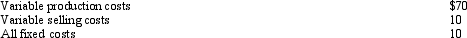

Dynamic Engine Corporation The Motor Division of Dynamic Engine Corporation uses 5,000 carburetors per month in its production of automotive engines.It presently buys all of the carburetors it needs from two outside suppliers at an average cost of $100.The Carburetor Division of Dynamic Engine Corporation manufactures the exact type of carburetor that the Motor Division requires.The Carburetor Division is presently operating at its capacity of 15,000 units per month and sells all of its output to a foreign car manufacturer at $106 per unit.Its cost structure (on 15,000 units) is: Assume that the Carburetor Division would not incur any variable selling costs on units that are transferred internally.

Assume that the Carburetor Division would not incur any variable selling costs on units that are transferred internally.

Refer to Dynamic Engine Corporation.What is the maximum of the transfer price range for a transfer between the two divisions?

Definitions:

Special Test for Qualifying Child

Criteria established by tax authorities to determine if a child is eligible for tax benefits, focusing on relationship, age, residency, and support.

Gross Income Test

A criterion used to determine if someone can be claimed as a dependent based on their income level.

Relationship Test

Criteria used in tax law to determine eligibility for filing status, dependent deductions, and other tax-related considerations based on familial relations.

Dependent Taxpayer Test

Criteria used to determine whether a taxpayer can claim another person as a dependent, including relationship, residency, and support tests.

Q13: The graphical approach to solving a linear

Q17: What are some common problems encountered in

Q24: When using a negotiated transfer price,a decision

Q36: Costs of decentralization include all of the

Q49: A capital budgeting method that measures the

Q82: The primary distinction between by-products and scrap

Q86: An organizational unit that is responsible for

Q121: Johnson Company Ellis Company produces two products

Q122: Sun Glo Company Sun Glo Company produces

Q159: Which of the following capital budgeting techniques