Hefner Corporation

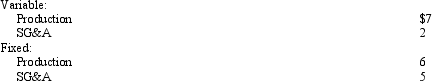

Hefner Corporation is comprised of two divisions: X and Y.X currently produces and sells a gear assembly used by the automotive industry in electric window assemblies.X is currently selling all of the units it can produce (25,000 per year)to external customers for $25 per unit.At this level of activity,X's per unit costs are:

Y Division wants to purchase 5,000 gear assemblies per year from X Division.Y Division currently purchases these units from an outside vendor at $22 each.

Y Division wants to purchase 5,000 gear assemblies per year from X Division.Y Division currently purchases these units from an outside vendor at $22 each.

Refer to Hefner Corporation.What will be the effect on overall corporate profits if the two divisions agree to an internal transfer of 5,000 units?

Definitions:

Sales Units

The number of individual items or units a business sells within a specific period.

Variable Expenses

Expenses that change in proportion to the activity of a business such as production volume or sales.

Fixed Expenses

Costs that do not change in total despite fluctuations in the volume of goods or services produced or sold.

Break-Even Point

The point at which total costs and total revenue are equal, meaning no profit or loss is generated.

Q4: The Institute of Management Accountants' Code of

Q5: Which of the following would be considered

Q9: Royal Pacific Corporation Royal Pacific Corporation is

Q19: In evaluating the profitability of a specific

Q40: Ellis Company Ellis Company produces two products

Q50: Process productivity is calculated as<br>A)total units divided

Q66: Benchmarks for performance measures may be monetary

Q68: Data that reflects future financial and non-financial

Q70: The balanced scorecard perspective that addresses things

Q145: The allocation of general overhead control costs