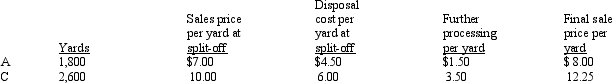

Johnson Company Ellis Company produces two products from a joint process: A and C Joint processing costs for this production cycle are $9,000.  If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company.Using sales value at split-off,what amount of joint processing cost is allocated to Product C (round to the nearest dollar) ?

Definitions:

Brand Assets

Valuable components or properties uniquely attributed to a brand that contribute to its equity and differentiation, including logos, trademarks, and customer goodwill.

Uniqueness

The quality of being the only one of its kind; in branding, it refers to features or attributes that set a brand apart from its competitors.

Brand Asset

Any resource associated with a brand that adds to its value, such as its name, logo, reputation, or intellectual property.

Q11: The relative sales value method requires a

Q11: A group of young teens was just

Q17: Two incidental products of a joint process

Q63: The costs generated by the cost management

Q65: Chambers Company<br>Chambers Company produces only two products

Q79: On what needs do (1)management accounting and

Q85: The potential rental value of space used

Q87: Girard Corporation Girard Corporation has two service

Q106: Joint cost allocation is useful for<br>A)decision making.<br>B)product

Q125: In linear programming,the equation that specifies management's