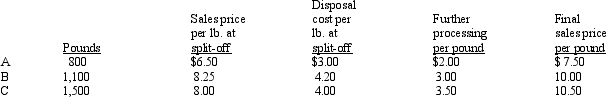

Davis Company Davis Company produces three products: A,B,and C from the same process.Joint costs for this production run are $2,100. If the products are processed further,Davis Company will incur the following disposal costs upon sale: A,$3.00; B,$2.00; and C,$1.00.

If the products are processed further,Davis Company will incur the following disposal costs upon sale: A,$3.00; B,$2.00; and C,$1.00.

Refer to Davis Company.Using a physical measurement method,what amount of joint processing cost is allocated to Product B (round to the nearest dollar) ?

Definitions:

Straight-line Depreciation

A method of allocating the cost of a tangible asset over its useful life, evenly distributing the depreciation expense each year.

Double Declining-balance

A method of accelerated depreciation where an asset’s value is reduced at double the rate of traditional straight-line depreciation.

Net Income

The resultant profit or loss after all expenses and incomes, including tax expenses have been accounted for, over a period.

Straight-line Method

An approach to determining depreciation by consistently allocating the expense of an asset throughout its expected life.

Q10: The nurse is aware that which of

Q19: Indirect costs should be allocated for all

Q34: The nurse has an order to administer

Q42: Memory Division of Missing Byte,Inc. The Memory

Q43: The set of processes that convert inputs

Q61: Costs incurred in the past to acquire

Q83: Borel Company<br>Borel Company produces three products from

Q86: List and explain the four Perspective of

Q130: Turner Company manufactures products A and B

Q142: The feasible region for an LP solution