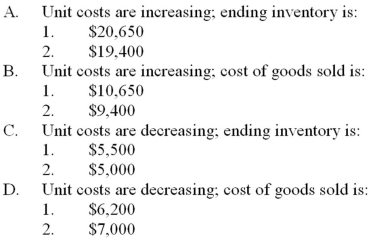

Given a particular set of facts and assumptions, the following pairs of amounts were computed using FIFO and LIFO. For each pair of amounts, indicate which amount resulted from applying FIFO, and which amount resulted from applying LIFO.

Definitions:

Inventory Cost Flow Assumptions

Assumptions made about how inventory costs move through a company's financial statements, including FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted average cost methods.

Descriptive Statements

Statements that provide detailed information or explanation about a specific topic, often used in documentation or reporting.

LIFO

Last In, First Out, an inventory valuation method that assumes goods purchased last are the first ones sold, affecting the cost of goods sold and inventory valuation.

FIFO

First-In, First-Out; an inventory valuation method where goods first purchased or produced are sold or used first.

Q1: Woodland Company uses the allowance method to

Q7: Amortization of discount on bonds payable will

Q16: The gross profit percentage is calculated by

Q33: Wages expense is an example of an

Q37: SRJ Corporation entered into the following transactions:

Q70: Which of the following statements is correct?<br>A)

Q78: Determine the effect of the following transactions

Q84: Grand Company authorized $150,000 of 5-year bonds

Q89: The following information is available for

Q122: The FIFO inventory method allocates the earliest