Redford Company hired a new store manager in October 2013, who determined the ending inventory on December 31, 2013, to be $50,000. In March, 2014, the company discovered that the December 31, 2013 ending inventory should have been $58,000. The December 31, 2014, inventory was correct. Ignore income taxes.

Required:

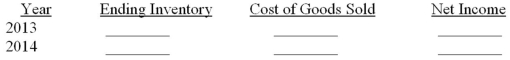

Complete the following table to show the effects of the inventory error on the four amounts listed. Give the amount of the discrepancy and indicate whether it was overstated (O), understated (U), or had no effect (N).

Definitions:

Important Test

A critical examination or assessment that has significant consequences or implications for the individual's standing, progress, or understanding in a specific area.

Intimate

Describes a close, personal, and often affectionate or loving relationship with someone.

Casually Dating

Engaging in romantic or sexual encounters without the commitment or label of a serious relationship.

Relationship Impact

The influence that interactions and connections with others have on an individual's emotional, psychological, and social well-being.

Q18: Which of the following is correct?<br>A) If

Q19: Which of the following statements best describes

Q28: Which of the following correctly describes

Q35: Schager Company purchased a computer system on

Q47: For the year ending December 31,

Q64: A deferred expense such as prepaid insurance

Q78: Superior Company has provided you with the

Q103: The gross profit percentage decreases when operating

Q109: Which of the following statements does not

Q111: Net sales plus cost of goods sold