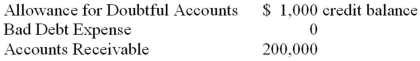

Prior to the year-end adjustment to record bad debt expense for 2014 the general ledger of Stickler Company included the following accounts and balances:  Cash collections on accounts receivable during 2014 amounted to $450,000. Sales revenue during 2014 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2014 would ultimately become uncollectible.

Cash collections on accounts receivable during 2014 amounted to $450,000. Sales revenue during 2014 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2014 would ultimately become uncollectible.

Required:

A. Calculate the bad debt expense for 2014.

B. Determine the adjusted 2014 year-end balance of the allowance for doubtful accounts.

C. Determine the net realizable value of accounts receivable for the December 31, 2014 balance sheet.

Definitions:

Designated Driver Systems

Designated driver systems are safety initiatives where individuals choose a non-drinking driver to transport them home safely, aiming to reduce alcohol-related accidents.

Commercial

A commercial is a paid advertisement or promotional message broadcast on television, radio, or online platforms, aimed at informing or persuading consumers about products, services, or brands.

Fishbein Model

A psychological theory or model that explains how individuals' beliefs about an object influence their attitude and behavior toward that object.

Three Components

In psychology, it refers to the model of attitudes comprising cognitive, affective, and behavioral components.

Q6: Superior has provided the following information for

Q7: Smith Corporation entered into the following transactions:

Q9: The trial balance is a listing of

Q14: For each independent situation given below, determine

Q76: When a credit sale is made with

Q90: TreeTop Corporation had issued $5,000,000 of 10-year

Q108: Which of the following transactions will result

Q108: Closing the revenue and gain accounts at

Q113: A contingent liability is reported on the

Q125: The allowance for doubtful accounts is reported