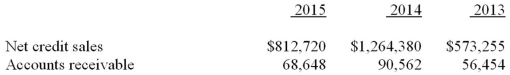

Matrix Corp. reported the following figures from its financial statements for the years 2013 through 2015.  Required:

Required:

A. Calculate for 2015:

1. Accounts receivable turnover

2. Average collection period

B. Calculate for 2014:

1. Accounts receivable turnover

2. Average collection period

C. Interpret the receivables turnover and the average collection period, in general. Comment on the change in the ratio results from 2014 to 2015. Then discuss how the trend in sales from 2013 to 2014 and 2015 may have affected the change in the ratios from 2014 to 2015.

Definitions:

Defender Strategies

Approaches used by organizations to protect their existing market share by improving efficiency and product quality, while not seeking to aggressively expand.

Prospector Strategies

Business strategies focused on growth and innovation, seeking out new markets, opportunities, and technologies to maintain competitive advantage.

Porter's Generic Strategies

A framework that outlines three strategies businesses can use to achieve competitive advantage: cost leadership, differentiation, and focus.

BCG Matrix

A strategic business tool to help organizations analyze their product lines or business units for strategic decision-making.

Q14: Determine the effect of the following transactions

Q26: The equipment cost initially reported on the

Q29: Which of the following is not a

Q45: Which of the following would be included

Q52: What is the net adjustment to net

Q64: Huron has provided the following year-end balances:

Q74: Which of the following transactions would not

Q74: Which of the following transactions would result

Q95: Flyer Company has provided the following information

Q98: At the beginning of 2014, Jeffrey Company