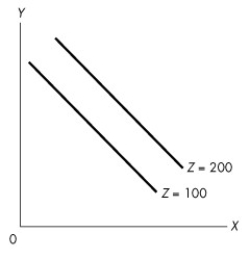

Use the figure below to answer the following questions.  Figure 1A.4.3

Figure 1A.4.3

-In Figure 1A.4.3,x is

Definitions:

Stock Options

Stock options grant the holder the right, but not the obligation, to buy or sell a company's stock at a predetermined price before a specified date.

Articles Of Incorporation

Legal documents filed with a governmental body to legally document the creation of a corporation, outlining its management structure, purpose, and other fundamental details.

Double Taxation

A situation where the same income is taxed twice, typically once at the corporate level and again when distributed to shareholders as dividends.

Company Management

The group of individuals responsible for making major decisions, overseeing operations, and managing the resources and strategy of a company.

Q18: For 2013,the maximum base for the Social

Q45: Which of the following is true of

Q46: Jerry and Ann paid the following

Q53: If Harold can increase production of good

Q61: For purposes of determining the adjusted basis

Q62: Jerry bought his home 15 years ago

Q69: Mark the correct answer.Self-employment taxes:<br>A)Consist of a

Q71: Janet is single and claims two allowances

Q84: Aaron has a successful business with $50,000

Q123: Complete the following sentence.Marginal cost<br>A)is the opportunity