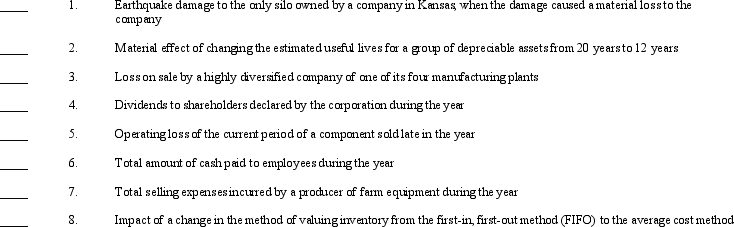

Accounting information might be separately reported in any of the following components of the income statement or statement of retained earnings and their supporting schedules and footnotes:

a. income from continuing operations or supporting schedules

b. extraordinary gains or losses

c. footnote disclosure

d. statement of retrined earnings

e. results from discontinued operations

Several items of accounting information are listed below.

Required:

Required:

By placing the letters (a-e)in the space provided above, identify where the information would be most appropriately reported.If the information would not appear in any of the above components, place an (X)in the space.Items may be reported in more than one location.

Definitions:

Nuclear Family

A social unit composed typically of two parents and their children, living together as a family.

Full-Time

Employment in which a person works a minimum number of hours defined as such by their employer, typically for five days a week.

Extended Family

A family that extends beyond the nuclear family, including grandparents, aunts, uncles, and other relatives, who all live nearby or in one household.

Immigrated

The action of moving to a new country or region with the intention of settling and living there permanently.

Q36: Which of the following errors normally would

Q40: Most trade receivables are initially recorded at

Q43: In a statement of cash flows prepared

Q62: On January 1, 2010, Patti Company purchased

Q67: <br>Refer to Exhibit 21-1.The balance of the

Q71: Companies should use petty cash funds to<br>A)pay

Q81: Which is not a key element of

Q82: On April 1, 2010, Milligan Company

Q84: Brockway, Inc.purchased some equipment on January 1,

Q111: Which of the following is not a