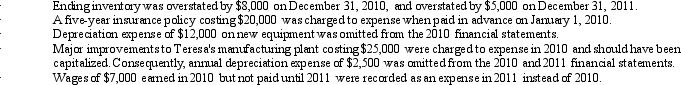

The 2010 and 2011 financial statements for Teresa Company had the following errors:

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.

Required:

Prepare a schedule to determine the correct net income for 2010 and 2011.Begin the schedule with reported net income for 2010 and 2011 and work to a corrected figure.Ignore income taxes.

Definitions:

Consolidated Net Income

The combined net income of a parent company and its subsidiaries, after adjustments for intercompany transactions.

Noncontrolling Interest

A minority shareholding in a company where the shareholder does not have the majority of voting rights.

Acquisition-Date Fair Value

The value of an asset or liability at the time of acquisition, determined according to applicable accounting standards for fair value measurement.

Controlling Interest

Ownership of a sufficient portion of a company's stock to dictate policies and make management decisions, typically over fifty percent.

Q3: Which of the following is a contra

Q9: On January 1, Lessee Company incorrectly recorded

Q18: Listed below are the five alternatives identified

Q23: Why did FASB decide it was necessary

Q23: Mantle Corporation has an accounting system that

Q30: When pledging accounts receivable<br>A)title to the receivables

Q47: Which of the following statements concerning the

Q48: In a statement of cash flows, the

Q55: Revenue recognition issues are studied because<br>A)there is

Q84: Below is a list of accounting assumptions,