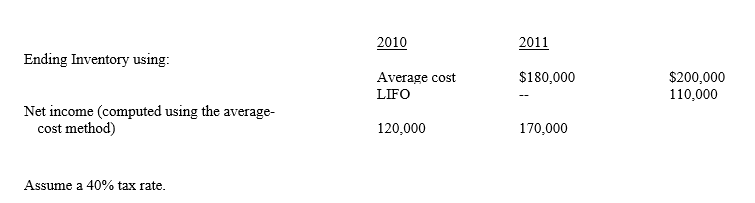

Wilma Company began operations in 2010 and uses the average cost method in costing its inventory.In 2011, Wilma is investigating a change to the LIFO method.Before making that determination, Wilma desires to determine what effect such a change will have on net income.Wilma has compiled the following information:  Assume a 40% tax rate.

Assume a 40% tax rate.

If Wilma adopted LIFO in 2011, net income would be

Definitions:

Economic Recession

An economic recession is a significant decline in economic activity across the economy, lasting more than a few months, typically visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Regulated Monopolies

Market situations in which local, state, or federal government grants exclusive rights in a certain market to a single firm.

Economic Recession

a period of temporary economic decline characterized by a decrease in GDP, income, employment, and trade, typically lasting from six months to a year.

Communism

Economic system in which all property would be shared equally by the people of a community under the direction of a strong central government.

Q3: Which of the following is a contra

Q16: On January 3, 2010, the Walton

Q16: Cash planning is important because a company

Q26: Several items to be considered in converting

Q30: When pledging accounts receivable<br>A)title to the receivables

Q48: Differences between pretax financial income and taxable

Q52: O'Rourke Co.reports assigned accounts receivable of

Q53: Full disclosure is desirable for all of

Q90: Which of the following correctly states a

Q98: The following information relates to the