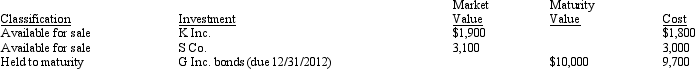

On January 1, 2010, A Corp.had the following investments:

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

Required:

What disclosures are required in the December 31, 2010 financial statements for investments?

Definitions:

Cost of Goods Manufactured

Total cost incurred by a company to produce goods during a specific period, including materials, labor, and overhead.

Manufacturing Process

A series of steps involved in the production of goods, typically involving raw materials, machinery, and labor to create finished products.

Day-to-Day Operations

Routine activities and tasks necessary for the ongoing functioning of a business or organization.

Work in Process Inventory

Goods that are partially completed in the production process, including the accumulation of labor, material, and overhead costs.

Q12: The fair value method of accounting for

Q16: On July 1, 2010, United Stereo purchased

Q36: In January 2009, Waterman Co.purchased a patent

Q50: Which one of the following would require

Q53: Rupert Company exchanged one business automobile for

Q56: A transfer of a security between categories

Q74: An impairment loss must be recognized when

Q83: On January 1, 2010, the Long Company

Q105: Singer Corporation sold $200, 000 of 12%

Q114: When the market rate of interest is