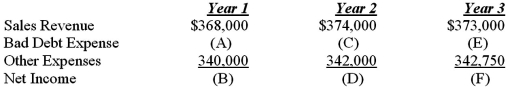

The Dubious Company operates in an industry where all sales are made on account.Historically,Dubious has experienced a steady 1.0% of credit sales being uncollectible.Presented below is the company's forecast of sales and expenses over the next three years.  Using this information:

Using this information:

a.Calculate bad debt expense and net income for each of the three years,assuming uncollectible accounts are estimated as 1.0% of sales.

b.Describe the trend in net income changes from Year 1 to Year 2 and from Year 2 to Year 3.

c.Suppose the company changes its estimate of uncollectible credit sales to 1.0% in Year 1,2.0% in Year 2 and 1.5% in Year 3.Calculate the bad debt expense and net income for each of the three years under this alternative scenario.

d.Describe the trend in net income changes determined in requirement c from Year 1 to Year 2 and Year 2 to Year 3.

e.Explain some of the factors that might cause the estimate of uncollectible accounts to vary from year to year as in part c above.

Definitions:

Accounting Equation

The fundamental principle of accounting that states Assets = Liabilities + Equity, which must always be in balance for accurate financial reporting.

Net Income

Net income is the total profit of a company after all expenses, including taxes and operational costs, are subtracted from its total revenue.

Total Liabilities

The sum of all financial obligations a company has to external parties, including both short-term and long-term debts.

Accounting Equation

The fundamental formula in accounting that states assets equal liabilities plus equity (Assets = Liabilities + Equity).

Q8: A declining fixed asset turnover ratio suggests

Q27: Over a two-year period,Coca-Cola's gross profit percentage

Q31: A machine had an estimated useful life

Q45: In a period of rising prices,the inventory

Q50: The purpose of adjusting entries is to

Q72: A company has current assets of $5

Q96: If an uncollectible account,previously written off,is recovered:<br>A)net

Q101: Which of the following statements regarding inventory

Q117: At the end of the accounting period,which

Q137: A company purchased equipment by issuing a