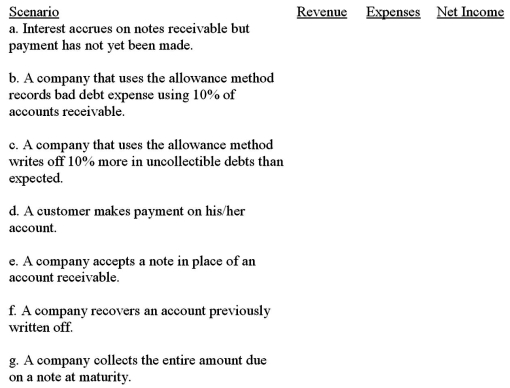

For each scenario below,indicate the appropriate change in current revenue,expenses and net income.Use the following symbols:  ,

,  ,or NE for no effect.

,or NE for no effect.

Definitions:

Sole Proprietorships

A business owned and operated by a single individual, where there is no legal distinction between the owner and the business entity.

Q17: The annual interest payment on bonds:<br>A)increases over

Q28: Which amount should be reported as cash

Q51: A company has 110,000 shares authorized,50,000 shares

Q68: What is the amount of gross profit?<br>A)$94,200<br>B)$98,700<br>C)$105,000<br>D)$32,700

Q74: When preparing this month's bank reconciliation,you find

Q81: Limited liability companies (LLCs)are like general partnerships

Q111: Gross profit is not a ledger account

Q111: According to the Sarbanes-Oxley Act (SOX),who are

Q124: Which of the following is not true

Q131: When originally purchased,a vehicle had an estimated