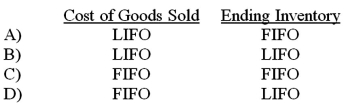

Generally,which inventory costing method approximates most closely the current cost for each of the following?

Definitions:

Current Tax Liabilities

Taxes owed to the government within the current fiscal year.

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Interest On Municipal Bonds

The periodic payments made to investors of municipal bonds, often exempt from federal and sometimes state and local taxes.

MACRS Depreciation

Modified Accelerated Cost Recovery System, a method of depreciation for tax purposes in the United States that allows a faster write-off of assets.

Q5: Impairment occurs when the estimated future cash

Q15: A company files a Form 10-K with

Q16: Which of the following statements regarding bonds

Q30: On October 31,2013,the bank's records say that

Q58: The book value or carrying value of

Q72: Companies using a perpetual inventory system:<br>A)never physically

Q87: An understatement of the beginning inventory balance

Q89: When the effective-interest method of amortization is

Q130: An increasing balance in the inventory account

Q138: The Dubious Company operates in an industry