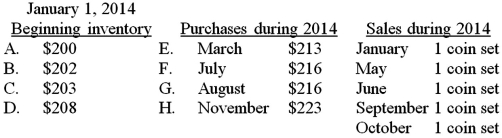

The following company buys and sells identical collectors' coin sets.The company uses LIFO.In the first two columns below,each coin set is identified by its letter and its cost.The third column indicates when coin sets were sold.

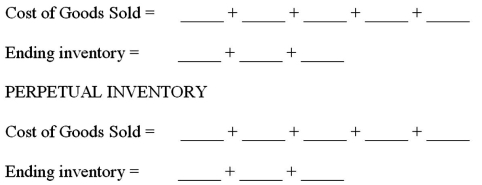

For each inventory costing method given below,fill in the blanks to indicate the letter of the coin set which will be used to calculate either cost of goods sold or the cost of ending inventory.  PERIODIC INVENTORY: Inventory is taken on December 31,2014.

PERIODIC INVENTORY: Inventory is taken on December 31,2014.  This example shows the cost of the coin sets increasing over time.Using the symbols ">" (greater than)," = " (equals),or "<" (less than),complete the following comparisons by filling in the blanks in the statements below.

This example shows the cost of the coin sets increasing over time.Using the symbols ">" (greater than)," = " (equals),or "<" (less than),complete the following comparisons by filling in the blanks in the statements below.

Using LIFO with increasing costs,cost of goods sold under periodic inventory _____ cost of goods sold under perpetual inventory.

Using LIFO with increasing costs,ending inventory under periodic inventory _____ ending inventory under perpetual inventory.

Using LIFO with increasing costs,net income under periodic inventory _____ net income under perpetual inventory.

Definitions:

Alcoholic Beverages

Drinks that contain ethanol, a psychoactive substance which is produced by the fermentation of sugars by yeasts.

Diarrhea

The condition of having loose or liquid bowel movements frequently, which can lead to dehydration if prolonged.

Stress

A psychological and physical response to perceived challenges or threats, resulting in a state of strain or tension.

Antidiarrheal Medications

Pharmaceuticals utilized to decrease the frequency of diarrhea by slowing the movement of the gut or by absorbing excess water in the bowel.

Q18: Cansing Company collected $5,000 from a customer

Q41: Maxell Company uses the periodic FIFO method

Q44: Use the above information to answer the

Q59: On December 31,2013,the balance in retained earnings

Q62: Bad Debt Expense is classified as<br>A)part of

Q70: During 2013,Shockglass Company recorded inventory purchases of

Q71: What is the total of the credit

Q77: Extraordinary repairs<br>A)are revenue expenditures.<br>B)extend an asset's life

Q86: Use the information above to answer the

Q105: A company reported a gross profit percentage