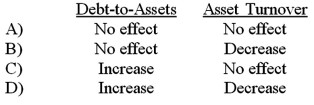

Which of the following accurately describes how the collection of cash on account from a customer would affect the ratios indicated?

Definitions:

Unsecured Debts

Debts that are not backed by an underlying asset, meaning lenders have no collateral to claim in case of default.

Maturities

The set dates when the principal amount of a debt instrument, such as a bond or loan, is to be paid back to the lender.

Unfunded Liabilities

Future retirement benefits and other obligations not covered by assets or financial reserves, often discussed in the context of pension plans.

Notes

Short-term or medium-term debt obligations issued by companies or governments.

Q13: A company using a perpetual inventory system

Q19: Bolster Soda had an accounts receivable turnover

Q36: Fill in the blanks below with the

Q40: Permanent accounts:<br>A)are not permitted under GAAP.<br>B)have their

Q74: BD One Company entered into the following

Q87: An understatement of the beginning inventory balance

Q107: The choice of an inventory costing method

Q132: Benchmarks are not<br>A)points of comparison to use

Q135: The allowance method for uncollectible accounts is

Q140: If an expense has been incurred but