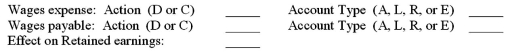

For each of the following transactions,match the action (Debit or Credit)and the account type (Asset,Liability,Revenue,or Expense)to each account for the appropriate adjustment that needs to be made at the end of June.Also,show the effect on Retained Earnings.

(D)Debit or (C)Credit

(A)Asset, (L)Liability, (R)Revenue or (E)Expense Account  or

or  Retained Earnings

Retained Earnings

a.The company has insurance costs of $620 a day for the month of June.On June 1 the company had $26,000 of prepaid insurance.  b.The company provides services in June for which it had received payment of $18,300 in May.

b.The company provides services in June for which it had received payment of $18,300 in May.  c.The company had $12,500 worth of labor performed by workers who will be paid in July.

c.The company had $12,500 worth of labor performed by workers who will be paid in July.  d.The company had income before income taxes of $287,400 for June and will pay taxes at the rate of 36%.The tax will be paid in July.

d.The company had income before income taxes of $287,400 for June and will pay taxes at the rate of 36%.The tax will be paid in July.  e.The company had interest of $1,000 due for June on a Certificate of Deposit (CD).The interest will be received in August.

e.The company had interest of $1,000 due for June on a Certificate of Deposit (CD).The interest will be received in August.

Definitions:

Q9: In a period of rising prices,the inventory

Q23: Which of the following situations would cause

Q23: The insurance policy covers four years and

Q38: Most companies report their sales revenue and

Q101: Cash equivalents are short-term,highly liquid investments purchased

Q102: Which of the following is not a

Q112: If the company doesn't have other sources

Q117: Which of the following statements is true?<br>A)If

Q119: The standard formatting for a journal entry

Q142: If a company decides to record an