Additional Information: Plant Assets That Originally Cost $67,200 Were Sold for $56,400,resulting

Additional information:

Additional information:

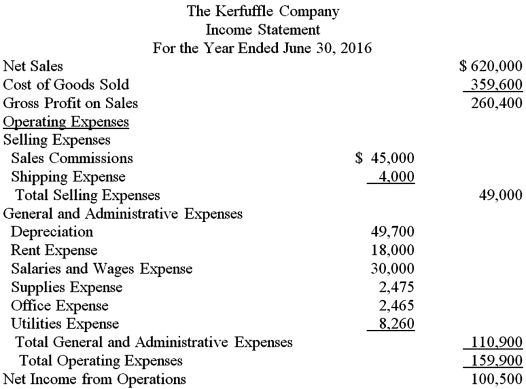

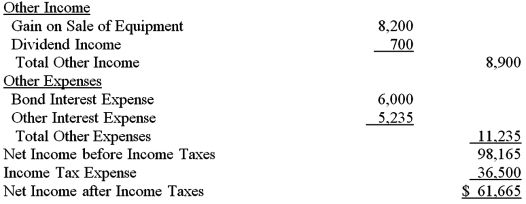

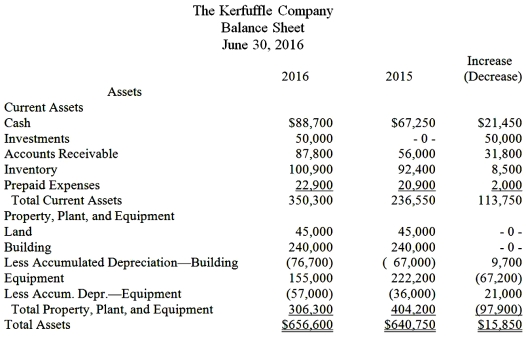

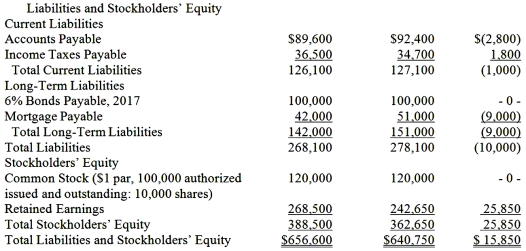

Plant assets that originally cost $67,200 were sold for $56,400,resulting in a gain of $8,200.

Dividends of $35,815 were declared and paid.There were no dividends declared in 2015.

Using the information provided,prepare the cash flows from investing activities for The Kerfuffle Company.

Definitions:

Legal Liability

The legal responsibility to compensate for harm caused by one's actions or failure to act in situations governed by law.

Accepting Offer

The act of voluntarily agreeing to the terms of an offer, thereby creating a binding contract between the offeror and the offeree.

Subject-To Clause

A term making a contract conditional on future events.

Love And Affection

An emotional state or feeling of strong attachment and personal bond towards another person or persons.

Q14: Office expenses such as postage and stationery

Q19: Labor and manufacturing overhead costs are often

Q51: Selected financial ratios for Opus Company and

Q54: At the end of the year,Harding Company

Q55: Roy Reynolds and Mike Truesdale are partners.To

Q59: Amounts paid to factory repair and maintenance

Q62: In the _ activities section of the

Q85: A corporation may report net income for

Q90: The partners' salary and interest allowances are

Q90: Cinders Inc,reported net income of $50,000 and