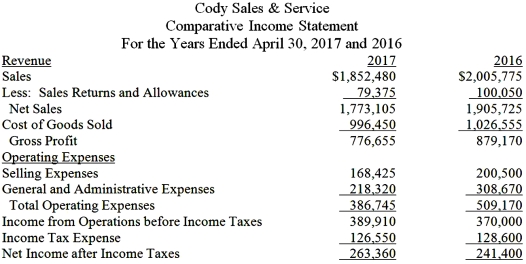

Using the information shown,prepare a vertical analysis.Carry all calculations to two decimal places and then round to one decimal place.(Leave all percentages unadjusted. )

Using the information shown,prepare a vertical analysis.Carry all calculations to two decimal places and then round to one decimal place.(Leave all percentages unadjusted. )

Definitions:

Cost of Capital

The rate of return a company must earn on its investment projects to maintain its market value and satisfy its shareholders and creditors.

Capital Budgeting

The approach taken by a business to appraise potential key projects or investments.

Equity Investment

The act of putting money into financial schemes, shares, property, or a commercial venture with the expectation of achieving a profit, primarily through the ownership of equity.

Separately Funded

A financial arrangement where specific projects or objectives are funded independently from an organization's main operating budget.

Q1: The entry to record the declaration of

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5411/.jpg" alt=" Calculate net income

Q23: The entry to record the investment of

Q25: State laws prohibit the issuance of stock

Q32: If a firm's accounts receivable increased during

Q51: Selected financial ratios for Opus Company and

Q67: Prestige Corporation has Sales of $98,500,Indirect Expenses

Q74: The price-earnings ratio is computed by dividing

Q76: After all revenue and expense accounts,other than

Q91: What is the PE ratio? How is