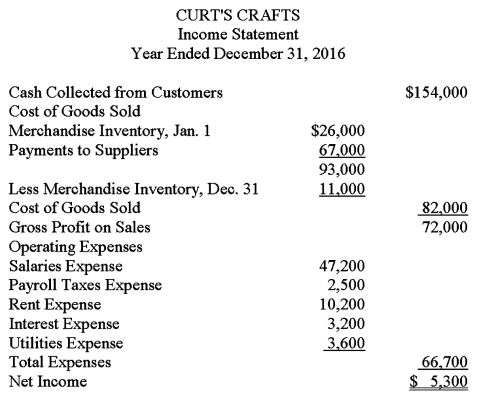

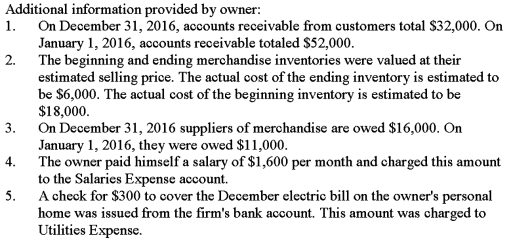

The income statement shown below was prepared and sent by Curtis Brown,the owner of Curt's Crafts,to several of his creditors.The business is a sole proprietorship that sells crafts and toys.An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles.Using the following additional information provided by the owner,prepare an income statement in accordance with generally accepted accounting principles.

Definitions:

Men's Coats

Clothing items designed specifically for men to wear over their other garments for warmth or protection.

Department Store

A large retail establishment offering a wide range of consumer goods across different product categories under one roof.

Budgeted Purchases

An estimate of the total value or quantity of goods a company plans to purchase over a specific period, typically part of the budgeting process.

Sales Forecast

Sales forecast is an estimate of the expected sales revenue for a particular period, based on historical data, market trends, and analysis.

Q13: Withdrawals of assets from a partnership that

Q14: Publication 15,Circular E contains federal income tax

Q35: The reductions from list prices that many

Q39: Form 940 must be filed _ time(s)a

Q41: Phones R Us uses a perpetual inventory

Q50: Abbott,Casper,and Costello are partners,sharing profits and losses

Q59: Compute the maturity value of a 9-month,9

Q71: To arrive at an accurate balance on

Q76: The cash payments journal for Excel Company

Q85: The individual amounts in the Accounts Payable