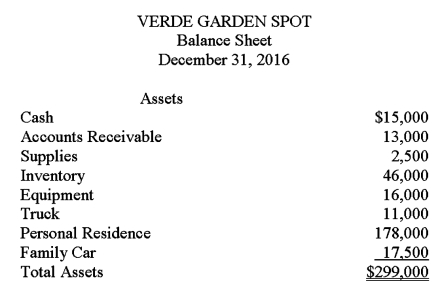

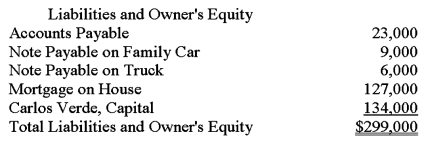

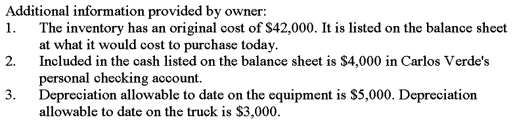

Carlos Verde owns a small nursery.He recently approached the local bank for a loan to finance an expansion of his nursery.Carlos prepared the balance sheet given below and submitted it with his loan application.The balance sheet does not conform to generally accepted accounting principles.Using the additional information provided by the owner,prepare a corrected balance sheet in accordance with generally accepted accounting principles.

Definitions:

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the total income.

Total Taxes

The cumulative amount of taxes owed by an individual or corporation to the government, including federal, state, and local taxes.

Taxable Income

The amount of income that is used to calculate an individual's or a company's income tax due.

Personal Income Tax

A tax levied on individuals or entities based on their income or profit earned.

Q1: Even if an interest-bearing note receivable is

Q5: Interest Expense is usually classified as a(n)_

Q12: A creditor's account in the accounts payable

Q24: Read each of the following transactions.Determine the

Q38: The _ principle requires that if income

Q39: All of the following refer to the

Q39: The monetary unit assumption assumes that:<br>A) the

Q54: The retail method is a means of

Q57: When checks are issued to employees after

Q82: In a firm that uses special journals,the