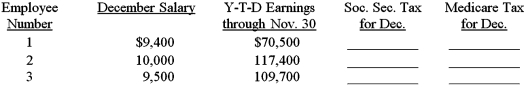

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Design Warehouse are listed below.Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December.Assume a 6.2 percent social security tax rate and a base of $113,700 for the calendar year.Assume a 1.45 percent Medicare tax rate.

Definitions:

Dehydration

A condition resulting from excessive loss of body water, impairing normal bodily functions.

Outstanding Performance

Exceptionally high achievement or skill level in a particular area or activity exceeding the standard norms.

Fixed Pattern

A sequence of behaviors or events that is predictable and consistent, often observed in natural or systematic processes.

Body Fluids

Liquids within the bodies of living organisms that carry out various functions, including blood, saliva, and lymph.

Q9: A firm purchased equipment for $12,000 on

Q10: Which of the following statements is NOT

Q26: GiGi's Sporting Goods uses special journals.If a

Q32: If adjustments are entered on a worksheet,it

Q44: Mary Gonzalez had total cumulative gross earnings

Q48: The accounts payable ledger for Dora's Dollar

Q56: Letters are used to label the debit

Q59: If an employee leaves the firm before

Q63: The frequency of deposits of federal income

Q65: In the closing procedure,the _ account balances