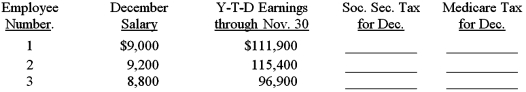

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of Heather's Hair Salon are listed below.Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December.Assume a 6.2 percent social security tax rate and a base of $113,700 for the calendar year.Assume a 1.45 percent Medicare tax rate.

Definitions:

American Women

Females residing in or are citizens of the United States, known for their diverse cultural, social, and economic backgrounds.

Respiratory System

The complex network of organs and tissues, including the lungs and airways, responsible for the exchange of oxygen and carbon dioxide between the body and the environment.

Leukocytes

White blood cells that are part of the immune system, helping to fight off infections and diseases.

Carbon Dioxide

A colorless, odorless gas produced by burning carbon and organic compounds and by respiration, essential to plant photosynthesis.

Q1: The balances of the ledger accounts for

Q16: On November 25,2016,the company paid $24,000 rent

Q20: Record the following transactions for the month

Q25: What is inventory shrink? How may inventory

Q25: One of the customer accounts from the

Q40: The use of the FIFO method of

Q61: The method of accounting for losses from

Q62: The purchases journal for Wright Company is

Q82: Beckett Co.sold merchandise on account for $10,600,terms

Q89: On November 30,2016,the general ledger of Hinges