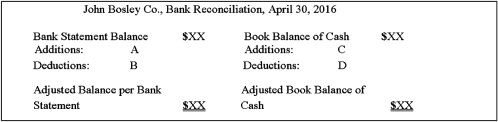

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.  A service charge charged by the bank.

A service charge charged by the bank.

Definitions:

CCA Class

A classification used in Canadian tax law for determining the depreciation rate for different types of tangible capital assets.

Leasing NET Advantage

A financial comparison metric that calculates the cost efficiency of leasing an asset rather than purchasing it, taking into account all associated expenses and savings.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary by income level, type of income, or legal entity.

CCA Tax Shield

A deduction that Canadian businesses can claim for the depreciation of tangible property, reducing taxable income.

Q27: Which of the following statements is not

Q31: If an adjustment is not recorded for

Q36: Which of the following statements is not

Q36: To arrive at an accurate balance on

Q43: The practice of estimating losses from uncollectible

Q56: Only the employer is responsible for paying<br>A)

Q56: Stan Still Stationery Store's employees are paid

Q56: A customer who returns goods or receives

Q60: Transactions are recorded in either a journal

Q60: After the Mansley Company paid its employees