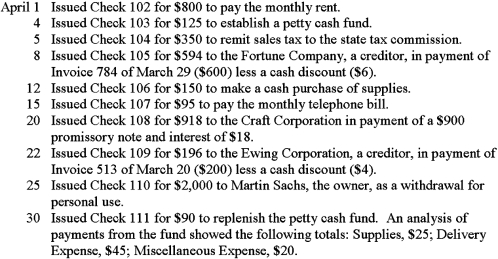

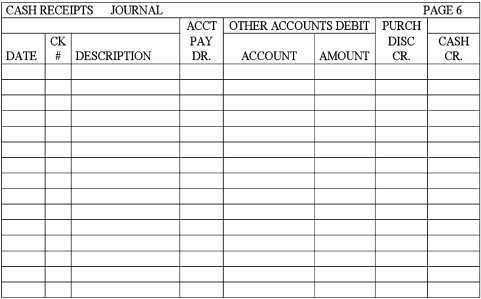

Record the following transactions for the month of April 2016 on page 6 of a cash payments journal.Total,prove,and rule the cash payments journal as of April 30.

Definitions:

Tax

A necessary financial obligation or other form of tax exacted from a taxpayer by a state institution with the aim of covering government expenses and various public financial needs.

Higher Prices

An increase in the cost of goods or services.

Tax

A compulsory monetary fee or different form of levy required from a taxpayer by a governmental body, used to finance government operations and various public costs.

Sellers

Entities or individuals that provide goods or services in exchange for payment, crucial to the operation of any market.

Q12: The accounts receivable ledger for Acme Auto

Q12: On a worksheet,the adjusted balance of Supplies

Q18: ABC Co.performed $5,000 of consulting work.Their customer

Q33: A journal entry can consist of no

Q38: The maturity value of a 60-day note

Q40: When transactions are entered in a general

Q40: The adjusted ledger accounts of RD Consulting

Q57: Purchases of merchandise on credit should be

Q57: Allowance for Doubtful Accounts has a debit

Q79: During one week,three employees of the Siesta