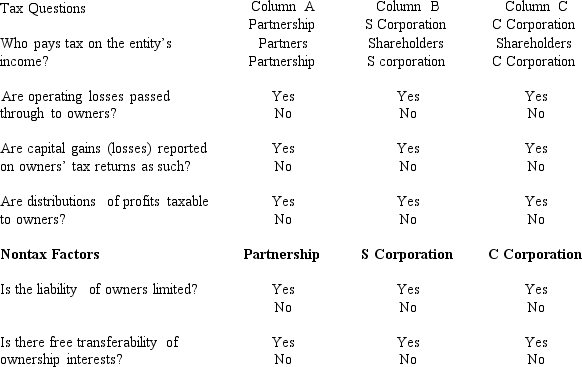

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Definitions:

Net Present Value

A method used in capital budgeting to assess the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows.

Discount Factor(s)

A numerical factor used to calculate the present value of future cash flows, reflecting how future values are worth less in today's terms.

Salvage Received

The amount of money or value received from selling or disposing of obsolete or excess inventory, equipment, or other assets.

Internal Rate Of Return

A metric used in capital budgeting to estimate the profitability of potential investments.

Q11: Penny, Miesha, and Sabrina transfer property to

Q13: All of a C corporation's AMT is

Q16: Wade and Paul form Swan Corporation with

Q21: Limited liability partnership<br>A)Organizational choice of many large

Q30: The AMT exemption for a C corporation

Q57: Negative AMT adjustments for the current year

Q86: Karen, an accrual basis taxpayer, sold goods

Q90: If the taxpayer elects to capitalize intangible

Q148: Partner's capital account<br>A)Adjusted basis of each partnership

Q176: Penalties paid to state government for failure