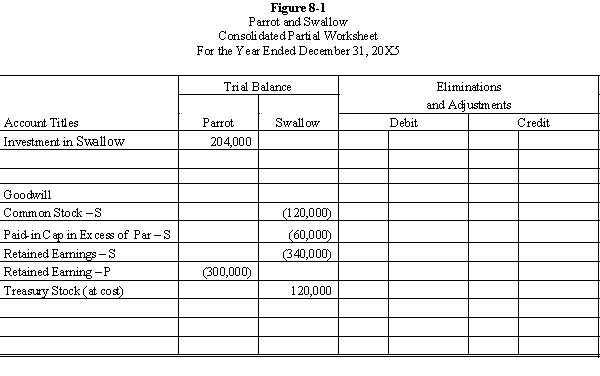

Parrot, Inc. purchased a 60% interest in Swallow Company on January 1, 20X1, for $204,000. Any excess of cost was attributable to goodwill.

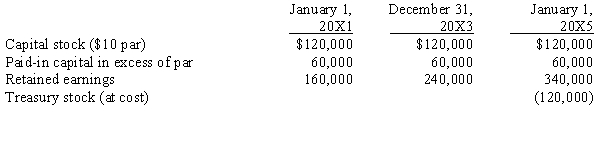

On January 1, 20X4, Swallow purchased 2,400 of its shares held by noncontrolling stockholders for $50 per share. Swallow equity balances on various dates were as follows:

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

Required:

Prepare the necessary determination and distribution of excess schedules and all Figure 8-1 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 20X5:

Definitions:

Manufacturing Overhead

All manufacturing costs that are not direct materials or direct labor, including costs associated with running the factory such as utilities and maintenance.

Overhead Cost

Expenses related to the operation of a business that are not directly tied to a specific product or service, such as utilities and rent.

Activity-Based Costing

A method of costing that identifies the relationship between costs, activities, and products, and through this relationship assigns indirect costs to products less arbitrarily than traditional methods.

Machine-Hours

A measure of the amount of time a machine is operated, used in manufacturing to allocate costs or determine efficiency.

Q5: Consolidated financial statements are designed to provide:<br>A)

Q7: A federal grant was received for research.

Q8: Assume that investments in an Endowment Fund

Q14: On January 1, 20X1 Bullock, Inc. sells

Q15: Company S is a 100%-owned subsidiary of

Q19: Major funds are described as<br>A) the general

Q37: On January 1, 20X8, Pope Company acquired

Q39: Dividends paid by a subsidiary have the

Q54: The following selected transactions affecting the Annuity

Q151: The microcirculation is composed of<br>A) arteries, arterioles,