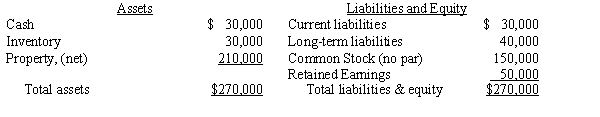

Plateau Company acquires an 80% interest in Seagull Company for $200,000 cash on January 1, 20X1. On that date, Seagull's equipment is undervalued by $25,000; any excess of cost over book value is attributed to goodwill. Seagull's balance sheet on the date of the purchase is as follows:

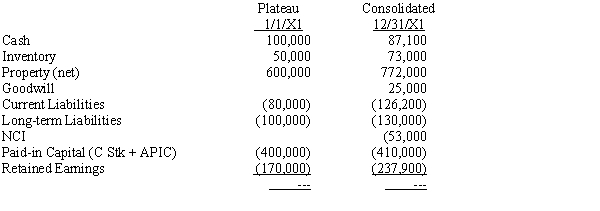

The controlling interest in consolidated net income for 20X1 is $97,900; the noncontrolling interest is $6,000. During the year Plateau retired long-term debt by issuing common stock. Dividends declared and paid during the year by Plateau and Seagull were $30,000 and $15,000, respectively. During the year Seagull sold equipment with a book value of $30,000 for a gain of $3,000; there were no purchases of property, plant, or equipment during the year.

The controlling interest in consolidated net income for 20X1 is $97,900; the noncontrolling interest is $6,000. During the year Plateau retired long-term debt by issuing common stock. Dividends declared and paid during the year by Plateau and Seagull were $30,000 and $15,000, respectively. During the year Seagull sold equipment with a book value of $30,000 for a gain of $3,000; there were no purchases of property, plant, or equipment during the year.

Required:

Required:

Prepare a statement of cash flows using the indirect method for Plateau Company and its subsidiary for the year ended December 31, 20X1.

Definitions:

Standard Price

A predetermined cost assigned to materials, labor, and overhead, used in budgeting and variance analysis.

Revenue Volume Variance

This reflects the difference between actual revenue and the expected revenue that was based on the budget, often attributed to changes in sales volume.

Planned Selling Price Sep## Actual Units Sold

This represents the comparison between the pre-established price at which goods were intended to be sold and the actual number of units sold.

Significant Variances

Major discrepancies between planned and actual figures in budgets, costing, or any financial metric.

Q2: Elimination procedures for intercompany bonds purchased from

Q4: U.S. accounting standards allow for several methods

Q10: When a new partner is admitted to

Q15: From the following information, prepare a statement

Q17: Which of the following is an expenditure

Q28: The following are selected activities for the

Q28: Al Alumni donates $5,000,000 to Great University

Q43: Which of the following is NOT a

Q184: When the heart is not ejecting blood

Q186: Organs that recondition the blood<br>A) receive disproportionately