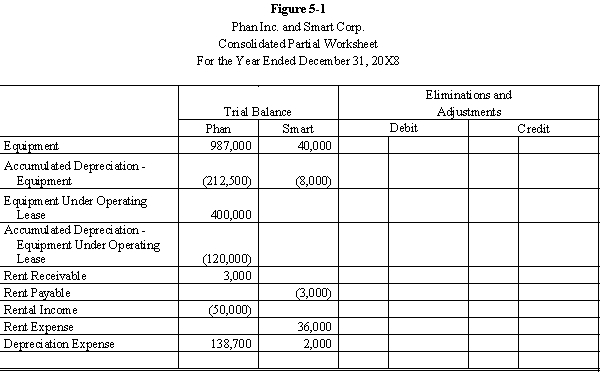

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X6, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-1 partial worksheet for December 31, 20X8. Key and explain all eliminations and adjustments.

Definitions:

Beginning Inventory

The value of goods available for sale at the start of an accounting period, critical for calculating cost of goods sold (COGS) and ending inventory.

Understated

A term used to describe financial statements or figures that are reported to be less than the actual amounts.

Current Period

Refers to the specific duration of time (usually a fiscal quarter or year) currently under consideration or analysis.

Net Realizable Value

The projected sales price of products subtracted by the expense of selling or disposing of them.

Q3: The following events are for South City

Q8: Vasoconstriction<br>A) refers to a decrease in the

Q18: The purpose of the Management Discussion and

Q19: What are the two primary approaches to

Q22: Lake City had the following transactions.<br> <img

Q27: A manufacturer produced a good with a

Q28: Using the information in Figure 15-1, the

Q29: The determination and distribution schedule for the

Q33: Gains and losses, in other than the

Q90: Blood flow is driven by osmotic pressure,