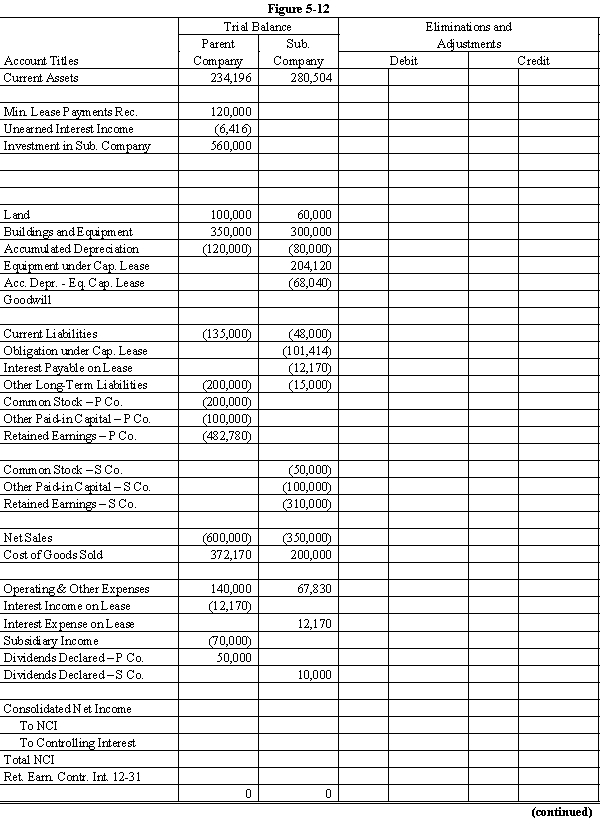

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $390,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

On January 1, 20X2, Parent purchased equipment for $204,120 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies.

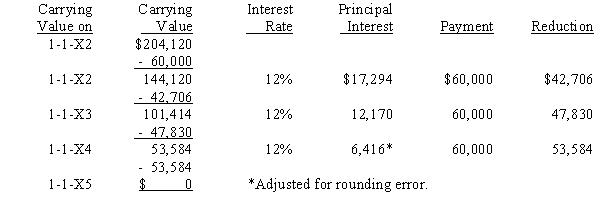

A lease amortization schedule, applicable to either company, is presented below:

On January 1, 20X3, Parent held merchandise acquired from Subsidiary for $10,000. During 20X3, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 20X3. Subsidiary's usual gross profit on affiliated sales is 40%.

On January 1, 20X3, Parent held merchandise acquired from Subsidiary for $10,000. During 20X3, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 20X3. Subsidiary's usual gross profit on affiliated sales is 40%.

Required:

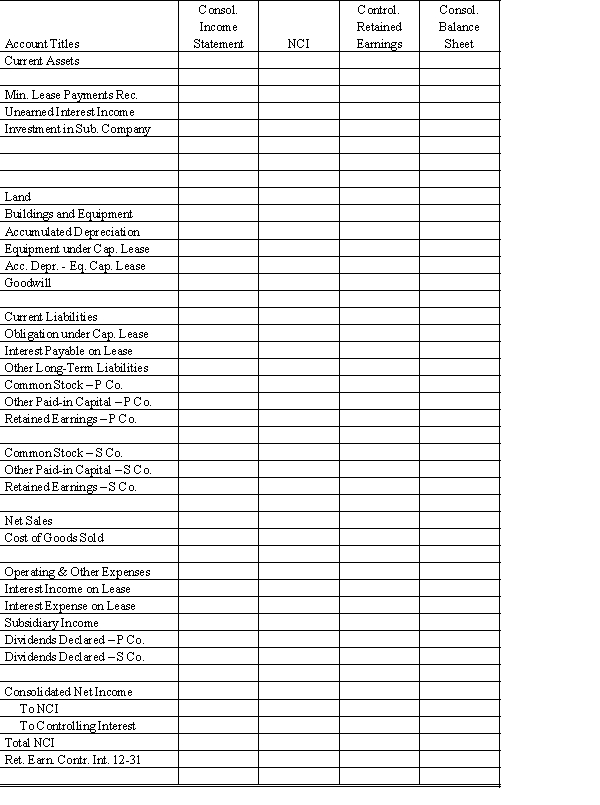

Complete the Figure 5-12 worksheet for consolidated financial statements for the year ended December 31, 20X3. Round all computations to the nearest dollar.

Definitions:

Thought Processes

Thought processes refer to the mental activities involved in understanding, processing, and communicating information.

Accidents

Unplanned, unforeseen events that can cause damage or injury due to a lack of intention or predictable cause.

Blindsight

A phenomenon where people who are perceptually blind in certain areas of their visual field demonstrate some response to visual stimuli without consciously perceiving them.

Parallel Processing

The ability of the brain to simultaneously process incoming stimuli of differing quality, facilitating complex tasks like vision and motor control.

Q11: Which of the following has not led

Q13: Partners Acker, Becker & Checker have the

Q16: Which does not cause arteriolar vasodilation?<br>A) decreased

Q18: Refer to Scenario 14-1. Adams & Beal

Q29: On December 31, 20X1, Parent Company purchased

Q29: On January 1, 20X1, Prange Company acquired

Q32: Refer to Patrick and Solomon. In both

Q44: South City Shelter is a voluntary health

Q70: For the following questions, choose the

Q76: Use the figure above to answer