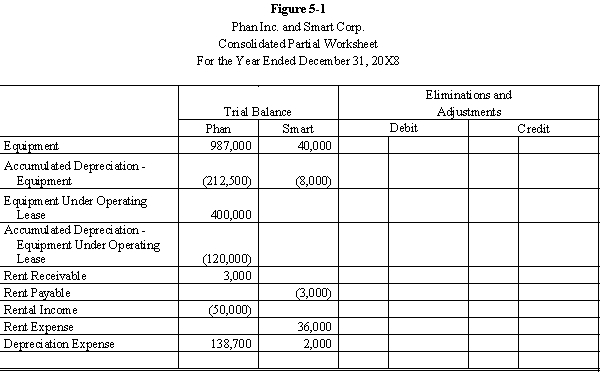

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X6, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-1 partial worksheet for December 31, 20X8. Key and explain all eliminations and adjustments.

Definitions:

Economic Well-being

The level of prosperity and quality of economic conditions that individuals or groups experience, often measured by income, employment, and access to resources.

Transfer Payments

Payments made by the government to individuals or other sectors without receiving a good or service in return, such as welfare, social security, and subsidies.

GDP

Gross Domestic Product, the total market value of all final goods and services produced within a country in a given period of time, often used to measure the economic performance of a country.

Real GDP

Gross Domestic Product adjusted for inflation, measuring the value of all goods and services produced by an economy in real terms.

Q5: On January 1, 20X1, Parent Company purchased

Q6: Able Company owns an 80% interest in

Q7: Describe the basic accounting for private not-for-profit

Q7: Endothelin causes arteriolar smooth muscle contraction.

Q8: The City of Warwick authorized a project

Q11: When it purchased Sutton, Inc. on January

Q19: Complete each of the following statments.<br>_ cells

Q27: Company S is a 100%-owned subsidiary of

Q75: If a letter in the alphabet is

Q98: During exercise, a larger percentage of the