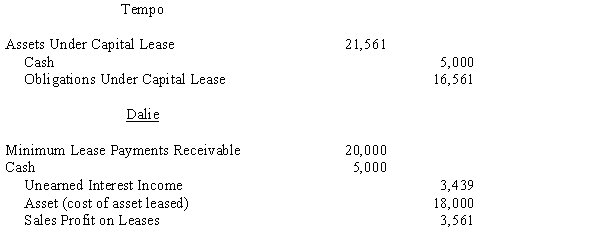

Tempo Industries is an 80%-owned subsidiary of Dalie Inc. On January 1, 20X8, Dalie leased an asset to Tempo and the following journal entries were made:

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

Required:

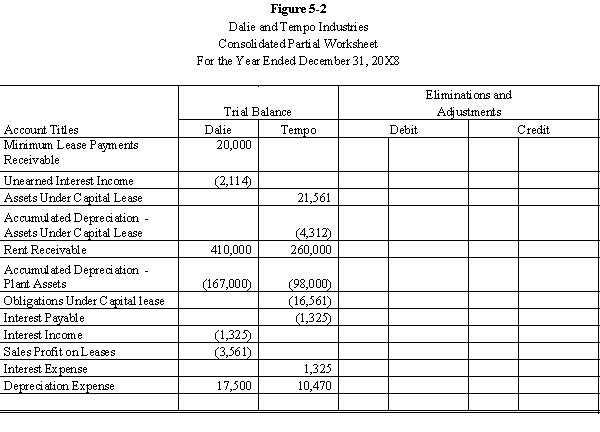

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-2 partial worksheet of December 31, 20X8. Key and explain all eliminations and adjustments.

Definitions:

Excretory

Pertaining to the process of eliminating waste products from the body's metabolism.

Waste Products

Substances that are produced as byproducts of metabolic processes and need to be eliminated from the body.

Crushing

Compressing or squashing something with force so that it becomes distorted, broken, or compacted.

Diabetes Mellitus

A chronic condition characterized by elevated levels of glucose in the blood due to insulin deficiency or resistance.

Q9: Able Company owns an 80% interest in

Q10: Company P acquired 75% of the outstanding

Q19: Because of their elasticity, arteries act as

Q19: Property taxes in the amount of $3,000,000

Q21: If goodwill is traceable only to the

Q30: Refer to the Pine and Scent scenario.

Q35: Endowment income was restricted to student aid

Q41: Complete each of the following statments.<br>The average

Q44: Zenato's Corporation is a chain of sandwich

Q162: The larger arteries assist with systemic blood