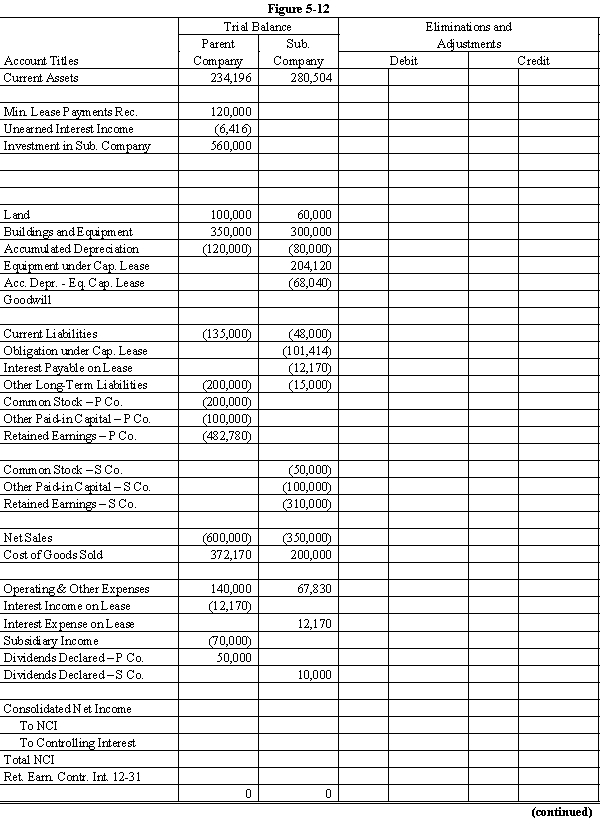

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $390,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

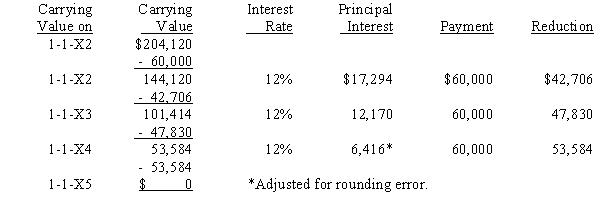

On January 1, 20X2, Parent purchased equipment for $204,120 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies.

A lease amortization schedule, applicable to either company, is presented below:

On January 1, 20X3, Parent held merchandise acquired from Subsidiary for $10,000. During 20X3, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 20X3. Subsidiary's usual gross profit on affiliated sales is 40%.

On January 1, 20X3, Parent held merchandise acquired from Subsidiary for $10,000. During 20X3, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 20X3. Subsidiary's usual gross profit on affiliated sales is 40%.

Required:

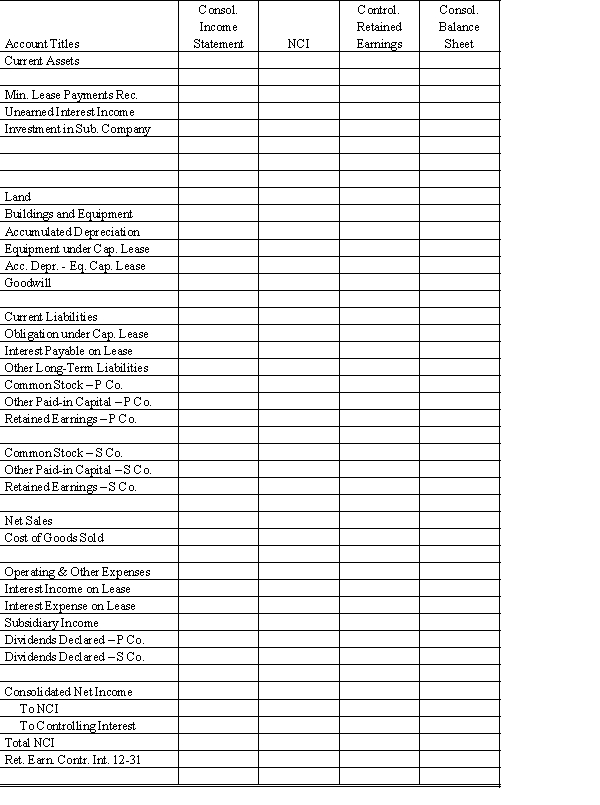

Complete the Figure 5-12 worksheet for consolidated financial statements for the year ended December 31, 20X3. Round all computations to the nearest dollar.

Definitions:

Core Medical Values

Fundamental ethical principles that guide medical practice, such as respect for autonomy, nonmaleficence, beneficence, and justice.

Primary Care Doctor

A healthcare professional who serves as the first point of consultation for patients and provides ongoing care for a variety of medical issues.

Rural Area

A geographical area located outside towns and cities, often characterized by lower population density, agricultural or natural landscapes, and limited infrastructure.

Doctors' Power

The influence and authority physicians hold in medical settings, affecting decisions, treatment options, and patient outcomes.

Q2: When recording the acquisition of a fixed

Q3: Schiff Company owns 100% of the outstanding

Q7: Refer to the Pine and Scent scenario.

Q11: On January 1, 20X1, Parent Company purchased

Q23: Glands are formed during embryonic development by

Q29: Indicate the relative comparison of each

Q78: What is the primary method by which

Q92: Velocity of blood flow is the slowest

Q112: The process of ultrafiltration<br>A) is movement of

Q128: The major function of the arterioles is