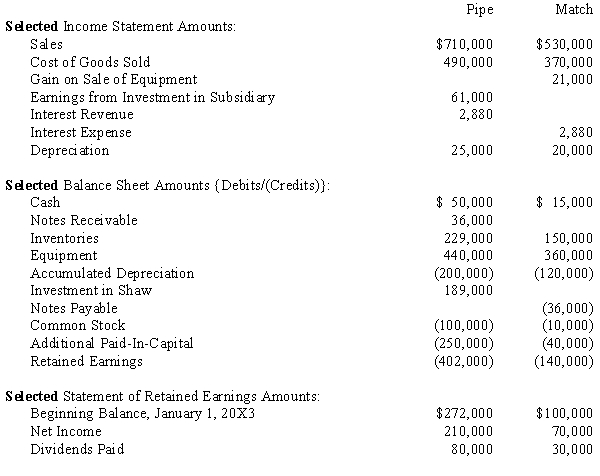

Account balances are as of December 31, 20X3 except where noted.

Additional Information:

Additional Information:

On January 2, 20X3 Pipe purchased 90% of Match for $155,000. On that date Match's shareholders' equity equaled $150,000 and the fair values of Match's assets and liabilities equaled their carrying amounts. Excess, if any, is attributed to patents and is amortized over 10 years.

On September 4, 20X3 Match paid cash dividends of $30,000.

On January 3, 20X3 Match sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Pipe for $36,000. The equipment had a remaining useful life of 3 years. Straight-line depreciation is used.

On January 4, 20X3 Match signed an 8% Note Payable. All interest payments were made as of December 31, 20X3.

During the year Match sold merchandise to Pipe for $60,000, which included a profit of $20,000. At year end 50% of the merchandise remained in Pipe's inventory.

Required:

1.Which method is Pipe using to account for the investment in Match? How do you know?

2.What elimination entry(ies) are associated with the elimination of intercompany profits due to the sale of merchandise?

3.What elimination entry(ies) are necessary with the sale of equipment by Match to Pipe?

4.What elimination entry(ies) are associated with the note to Match? Why are the entry(ies) made?

Definitions:

Alcohol Abuse

The harmful consumption of alcohol that negatively affects one's health, social, or occupational life.

Acute Pancreatitis

A sudden inflammation of the pancreas that causes severe abdominal pain and, potentially, life-threatening complications.

B Vitamins

A group of water-soluble vitamins that play important roles in cell metabolism and energy production.

Imbalanced Nutrition

A state wherein an individual's dietary intake does not provide the necessary nutrients for proper health and functioning.

Q2: The goal of the consolidation process is

Q7: In the Comprehensive Annual Financial Report (CAFR)

Q19: Which of the following statements is true

Q21: Supernova Company had the following summarized balance

Q25: The Planes Company owns 100% of the

Q41: Consolidated Basic Earnings Per Share (BEPS) is

Q49: If a government enters into a securities

Q69: Histamine released in injured areas produces local

Q95: Use this figure to answer the

Q184: When the heart is not ejecting blood