PROBLEM

Scenario 3-4

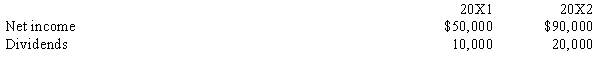

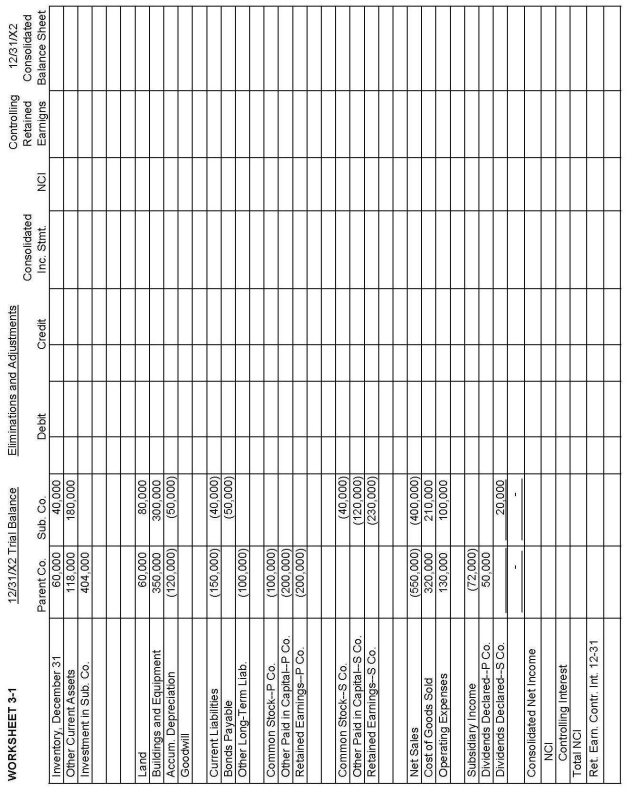

On January 1, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for $316,000. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively. Net income and dividends for 2 years for Subsidiary Company were as follows:

On January 1, 20X1, the only tangible assets of Subsidiary that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $5,000 more than cost. The inventory was sold in 20X1. Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is goodwill.

On January 1, 20X1, the only tangible assets of Subsidiary that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $5,000 more than cost. The inventory was sold in 20X1. Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is goodwill.

-Refer to Scenario 3-4 and Worksheet 3-1.

Required:

a. Complete the consolidating worksheet for December 31, 20X2.

b. Prepare supportive Income Distribution Schedules for Subsidiary and Parent.

Definitions:

Total Profits

The overall financial gain made by a business, calculated as the total revenue minus total expenses.

Utility Function

A representation or model that quantifies an individual's preferences for various outcomes or bundles of goods and services, used in economics to analyze behavior.

Auto Repairs

Services aimed at diagnosing and fixing problems related to a vehicle's performance or condition.

Gasoline

A flammable liquid derived from petroleum, used mainly as fuel in internal combustion engines.

Q6: The purchase of additional shares directly from

Q11: If the functional currency is determined to

Q14: Complete each of the following statments.<br>_ are

Q19: Which of the following financial statements is

Q20: Complete each of the following statments.<br>The _

Q34: In determining if two operating segments may

Q49: The incremental income tax effect utilized to

Q54: The movements of fluid across the capillary

Q123: The regulation of blood flow in the

Q188: What is the primary reason that edema