Scenario 3-1

Pedro purchased 100% of the common stock of the Sanburn Company on January 1, 20X1, for $500,000. On that date, the stockholders' equity of Sanburn Company was $380,000. On the purchase date, inventory of Sanburn Company, which was sold during 20X1, was understated by $20,000. Any remaining excess of cost over book value is attributable to patent with a 20-year life. The reported income and dividends paid by Sanburn Company were as follows:

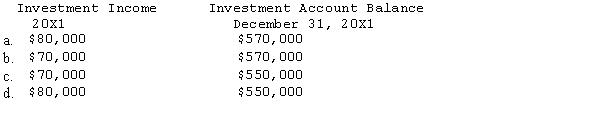

-Refer to Scenario 3-1. Using the simple equity method, which of the following amounts are correct?

Definitions:

Q3: Refer to the Dills and Sarada scenario.

Q16: Which one of the following statements is

Q17: A partner's maximum loss absorbable is calculated

Q20: Complete each of the following statments.<br>The _

Q21: On January 1, 20X1, Parent Company acquired

Q31: Which of the following does not describe

Q31: A trust created through a will is

Q37: The primary purpose of an estate's charge

Q44: Under the doctrine of marshaling of assets,

Q207: A local increase in potassium increases the