Scenario 2-1

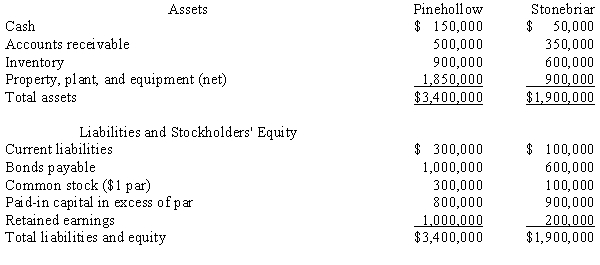

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. The journal entry to record the purchase of Stonebriar would include a

Definitions:

Elastic Bandage

A stretchable bandage used to create localized pressure, commonly utilized to reduce swelling and support injured joints or muscles.

Severe Strain

A significant or extensive injury to a muscle or tendon, caused by overstretching or tearing.

Swelling

An increase in size or volume of a body part, typically resulting from inflammation or accumulation of fluid.

Wound Dressing

The application of materials (such as bandages, gauze, or plasters) to a wound to protect it from infection, absorb discharge, and promote healing.

Q4: Ace & Barnes partnership has income of

Q7: Oak, Pine, and Maple are partners with

Q10: Lancaster Inc. expects to have taxable

Q15: Which of the following characteristics of a

Q15: The cash purchase of a controlling interest

Q16: Company S is a 100%-owned subsidiary of

Q23: Refer to Porter & Solheim. On January

Q25: In the year 2005, a group of

Q32: When a parent purchases a portion of

Q45: Elder Care Services is a not-for-profit provider