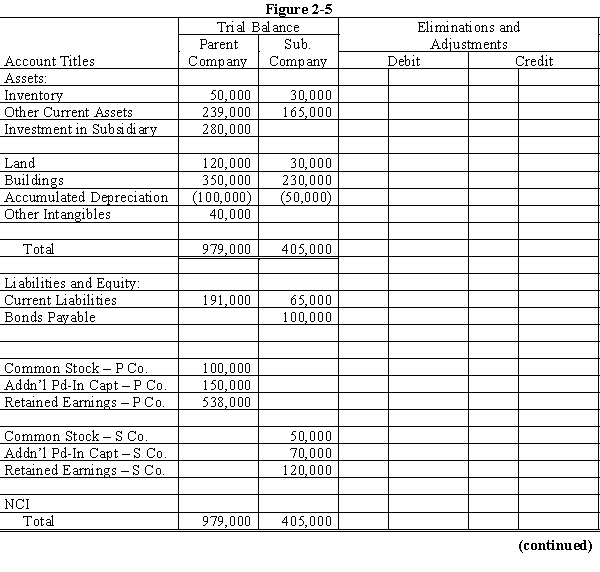

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $240,000.

On January 1, 20X1, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment. The fair value of land is $50,000. The fair value of building and equipment is $200,000. The book value of the land is $30,000. The book value of the building and equipment is $180,000.

Required:

a.

Using the information above and on the separate worksheet, complete a value analysis schedule

b.

Complete schedule for determination and distribution of the excess of cost over book value.

c.

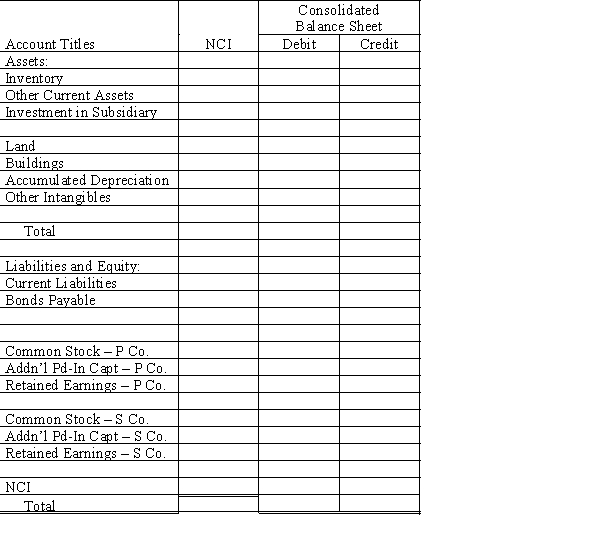

Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 20X1.

Definitions:

Balance Sheet Accounts

Categories within the balance sheet that include assets, liabilities, and shareholders' equity, each of which is essential for showcasing the company's financial health.

Natural Business Year

A fiscal year that ends when a business's sales activities are at their lowest point, facilitating easier inventory and activity analysis.

12-month Period

A 12-month period typically refers to a full year, used in financial reporting and analysis to compare performance or changes over the span of a year.

Income Summary Account

A temporary account used in the closing process to summarize the period's revenues and expenses before transferring the net income or loss to retained earnings.

Q4: Lee, Alverez, and Tyne have a partnership.

Q7: Refer to the Pine and Scent scenario.

Q10: Dickinson Corporation is considering the acquisition of

Q11: Which of the following is NOT considered

Q17: A partner's maximum loss absorbable is calculated

Q18: Which of the following would not be

Q23: On December 1, $125,000 was deposited with

Q24: A parent company owns a 90% interest

Q26: For estate planning purposes, Albert began distributing

Q42: The respiratory system<br>A) obtains O<sub>2</sub> from and