Scenario 2-1

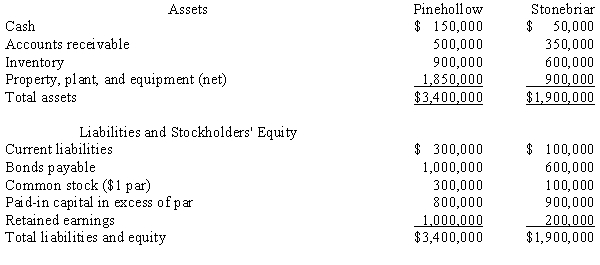

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. The journal entry to record the purchase of Stonebriar would include a

Definitions:

Sclera

The white or sclerotic outer coat of the eye.

Musculature

The system of muscles within the body, contributing to physical strength, movement, and posture.

Rule Out

To eliminate or exclude something as a possibility through investigation or evidence.

Abbreviation R/O

Stands for "Rule Out," used in medical context to indicate excluding a diagnosis.

Q4: The body currently responsible for developing local

Q6: The partnership of Able, Bower, and

Q20: A owns 80% of B and 20%

Q21: Which of the following is a feedforward

Q25: Changes in partnership ownership are presumed to

Q29: Which of the following receipts should be

Q32: An administrator differs from an executor of

Q49: Beginning with the chemical level and ending

Q50: The entry in the General Fund to

Q196: Complete each of the following statments.<br>Mean arterial