Scenario 2-1

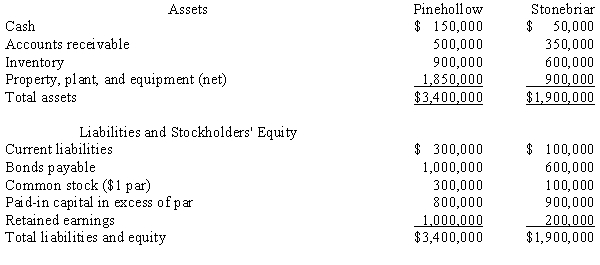

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. Goodwill associated with the purchase of Stonebriar is ____.

Definitions:

Results

The outcomes or conclusions that arise from an action, experiment, or process, indicating its success, failure, or findings.

Action Verbs

Verbs that express a physical or mental action, often used to make sentences more dynamic and persuasive in communication.

Quantified Results

Measurable outcomes derived from an experiment, study, or action, often presented in numerical form.

Writing Styles

The distinct manner or technique an author uses in their written expression, shaped by elements like tone, structure, and voice.

Q11: On January 1, 20X1, Parent Company purchased

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3676/.jpg" alt=" Assuming Investor owns

Q30: The fair market value of a partnership

Q31: Which of the following would appear in

Q31: When a parent purchases a portion of

Q33: Refer to Scenario 12-1. The minimum amount

Q34: Which of the following organizations would be

Q35: An American firm owns 100% of a

Q46: If goodwill is suggested by the consideration

Q53: Which of the following accounts would not