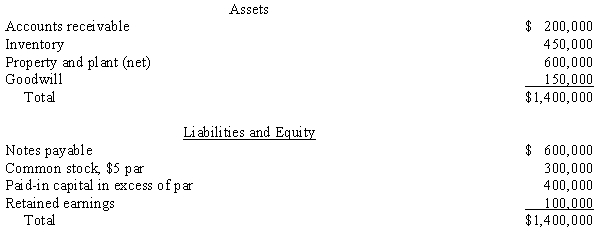

Supernova Company had the following summarized balance sheet on December 31, 20X1:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20/share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.

What journal entry will Redstar Corporation record for the investment in Supernova?

b.

Prepare a supporting value analysis and determination and distribution of excess schedule

c.

Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Definitions:

Fast-growth Firms

Fast-growth Firms are businesses characterized by their rapid expansion in terms of revenue, user base, or market share, often driven by scalable business models and innovative products or services.

Timmons Model

The Timmons Model of entrepreneurship focuses on the dynamic process of balancing opportunity, team, and resources, emphasizing that success is contingent upon the fit and balance among these elements.

Financial Practices

The methods, strategies, and operations used by an organization or individual to manage their financial resources and records.

Voting Control

The power to influence or determine outcomes within an organization through the possession of voting shares or rights.

Q1: Maxwell is trying to decide whether to

Q3: In the functional or current method of

Q7: Which of the following statements applying to

Q8: Kerry Manufacturing Company is a German

Q20: Complete each of the following statments.<br>The _

Q32: Refer to Patrick and Solomon. In both

Q38: Property taxes are recorded as revenue in

Q38: If a bonus is traceable to the

Q43: Which of the following is NOT a

Q54: The following selected transactions affecting the Annuity