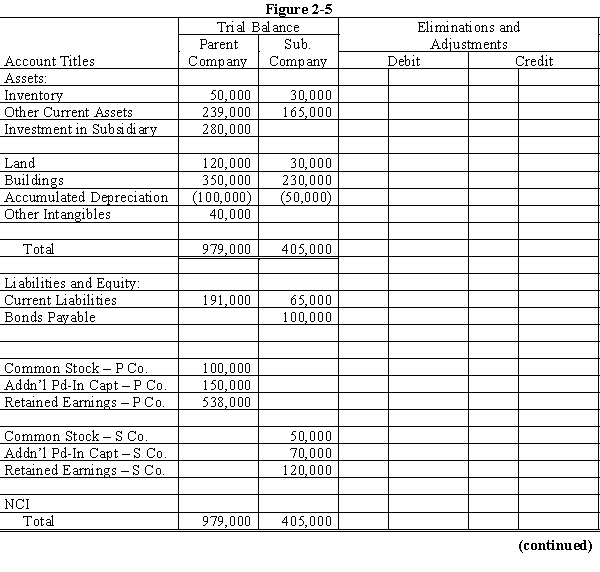

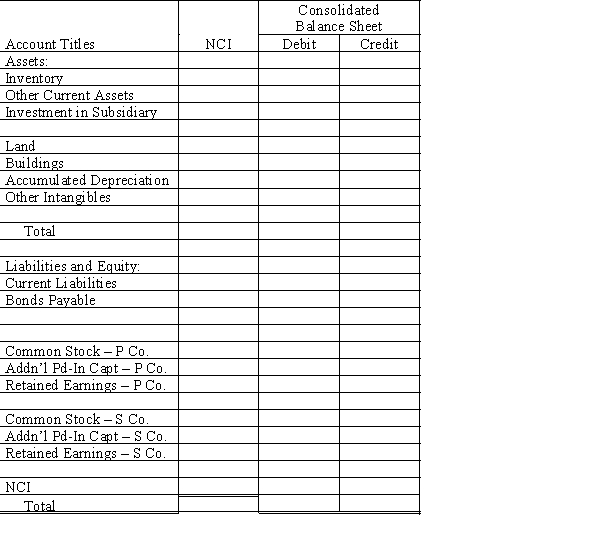

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $240,000.

On January 1, 20X1, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment. The fair value of land is $50,000. The fair value of building and equipment is $200,000. The book value of the land is $30,000. The book value of the building and equipment is $180,000.

Required:

a.

Using the information above and on the separate worksheet, complete a value analysis schedule

b.

Complete schedule for determination and distribution of the excess of cost over book value.

c.

Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 20X1.

Definitions:

Market Segments

The classification of a broader market into smaller consumer groups with similar needs, characteristics, or behaviors.

Customers

Individuals or businesses that purchase goods or services from a company.

Geographic Reach

The scope or extent of an area covered by the operations, services, or influence of a business or organization.

BlackBerry

A line of smartphones and services designed and marketed by the Canadian company BlackBerry Limited.

Q6: The purchase of additional shares directly from

Q8: Assuming that no stipulation is made in

Q10: Lancaster Inc. expects to have taxable

Q16: The most significant difference between accounting principles

Q23: Which of the following results in dissolution

Q30: The main difference between an agency fund

Q31: Which of the following would appear in

Q40: Refer to Scenario 12-1. The minimum amount

Q41: Abel Corporation sold equipment in the first

Q54: Larson, Inc. sold merchandise for 600,000 FC