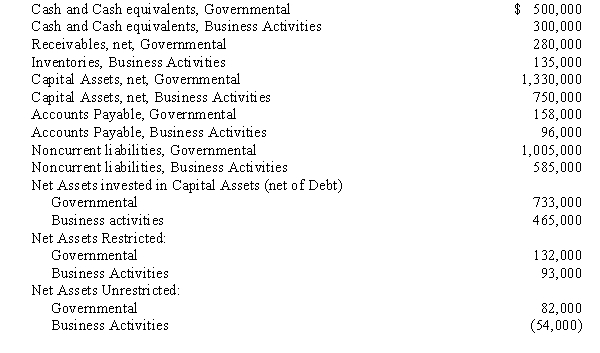

From the following information, prepare a statement of net assets for the city of Franklin as of June 30, 20X3:

Definitions:

Consolidated Net Income

The total net income of a parent company and its subsidiaries, after eliminating intercompany transactions.

Unrealized Profit

Profit that has been made on paper through an investment but has not yet been realized by selling the asset in question.

After-tax Gain

The amount of profit that remains after subtracting the taxes owed on the gain.

Intercompany Profit

Intercompany profit arises from transactions between units of the same company, requiring elimination during the consolidation process to avoid inflating revenues and profits.

Q6: The primary emphasis of interim reporting is

Q8: Which of the following statements is true

Q9: Which of the following people exemplifies characteristics

Q16: A parent company owns a 100% interest

Q20: Olsen and Katch organized the OK Partnership

Q24: A parent company owns a 90% interest

Q31: Which of the following characteristics was identified

Q37: Rockee Corporation, a bio-tech firm, has found

Q40: A redemption of the final serial of

Q47: Refer to Palm and Star. The elimination