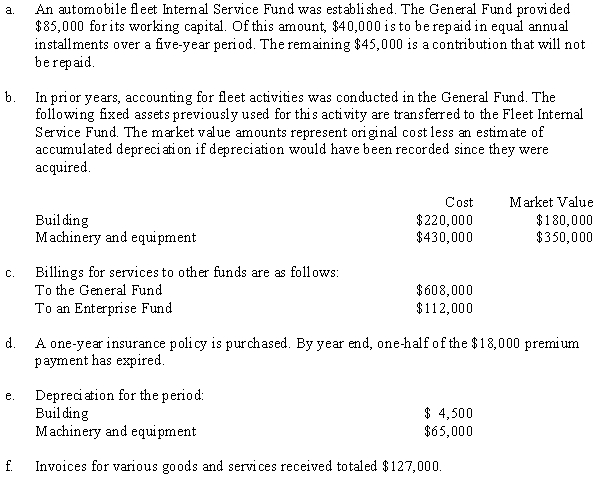

The following selected events occurred in Hershey City's Internal Service Fund for its automobile fleet:

Required:

Required:

Omitting explanations, prepare journal entries for all funds and groups affected, using the following format:

Definitions:

Home Mortgage

A loan provided by a financial institution to a borrower for the purchase of a residential property, secured by the property itself.

Tax-Exempt Securities

Investments whose interest income is not subject to federal income tax, and in some cases, state and local taxes.

Residence Acquisition Debt

Mortgage debt incurred in acquiring, constructing, or substantially improving a principal residence, which is secured by the residence.

Fully Deductible

Expenses that can be subtracted in full from taxable income, reducing the total amount on which tax is calculated.

Q5: On January 1, 20X1, Parent Company purchased

Q10: The best definition for direct quotes would

Q20: The following events are for the Public

Q23: A donation was received by a voluntary

Q24: Farley College budgets funds for the maintenance

Q31: Which of the following is a mandatory

Q31: FASB Statement #52 requires which of the

Q34: Which of the following themes did Baltes

Q41: A voluntary welfare organization is permitted to

Q42: The entry to record the Warwick City