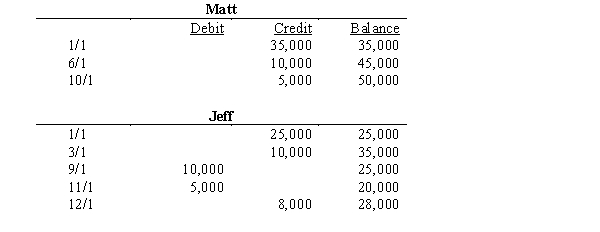

Matt and Jeff organized their partnership on 1/1/00. The following entries were made into their capital accounts during 00:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

a.

Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.

A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.

Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.

A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

Definitions:

Indirect Method

A technique used in cash flow statement preparation that starts with net income and adjusts for non-cash transactions and changes in working capital to arrive at cash flow from operating activities.

Operating Activities

Business actions that pertain to the primary operations of a company, including production, distribution, and other processes that generate revenue.

Net Income

The total profit or loss of a company after all revenues, expenses, taxes, and costs have been subtracted from total revenue.

Operating Activities

Business activities directly related to the production, sale, and delivery of a company's products or services, generating the majority of its revenue and expenses.

Q2: A U.S. firm purchased 100% of

Q6: On December 31, 20X1, Priority Company purchased

Q10: Balter Inc. acquired Jersey Company on

Q10: In order to convert the governmental fund

Q12: In a not-for-profit organization, depreciation on capital

Q21: Describe the circumstances that must be true

Q23: Goodwill is an intangible asset. There are

Q24: The Chan Corporation purchased the net assets

Q41: In a hedge of a forecasted transaction,

Q60: On January 1, 20X1, Rapid Corporation purchased